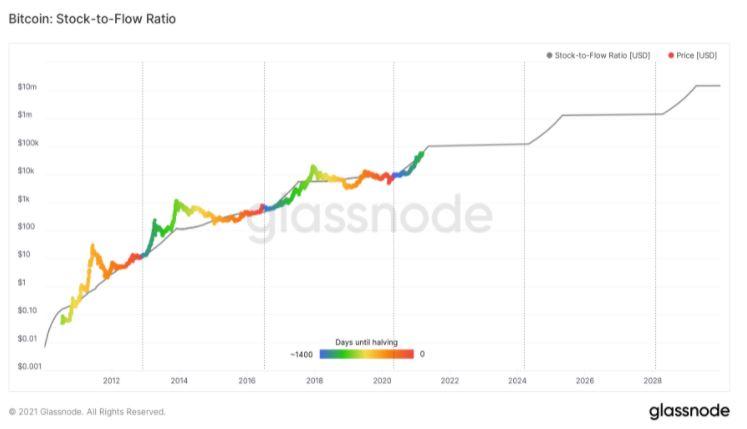

Bitcoin: Model Stock to Flow

The stock to flow model is not a magic metric that can predict the Bitcoin price trend.

It is a very simple model, developed by PlanB (a well-known trader) that shows the evolution over time of the relationship between current stock of an asset and flow, that is the flow of new production

Stock: circulating supply, i.e. the number of "pieces" in circulation of a particular asset

Flow: emission of the good on the market.

This model is useful for making price forecasts of precious metals such as gold and silver, as they are expensive to produce and have a low or limited flow in time.

The metric puts the focus of attention on the concept of scarcity.

Bitcoins, just like gold and silver are scarce lows.

Bitcoins are not infinite, rather there is a programmed cap at 21 million pieces.

Every 4 years, the supply of "producible" Bitcoins, is halved. I will elaborate on this in a future article.

It is estimated that by 2140, all Bitcoins will have been digitally mined. From that date on, no more Bitcoins will be producible.

These characteristics make Bitcoin a deflationary asset, with a limited supply that is steadily reduced over time.

The S2F (stock to flow) metric, has been very useful in the past to roughly delineate the price trend of Bitcoin.

Knowing the exact timing of when the next Bitcoins will be mined, Plan B was able to build a very optimistic linear forecast, justified by the halving of supply that Bitcoin is "victimized" by every 4 years.

The objective of the model is not to identify the price in the short term, but rather to determine in general thelong-term trend.

In fact, although Bitcoin has been misaligned several times with the S2F forecasts we see how, over time it has retracted its steps and followed the predicted trend.

Very interesting to note that by 2025 Bitcoin is expected to be around $1 million per piece.

Criticism of the Stock to Flow Model

The Stock to Flow Model, while accurate in the past, remains too general an indicator.

It relies only on linear regression in a view that price should be determined solely by supply.

In essence, the model does not take into account demand trends over time, focusing solely on supply.

As you know, the price of a financial asset is based on the relationship between supply and demand, so a study based solely on supply may not be as accurate as hoped.

If the whole world decides to turn its back on Bitcoin, surely S2F would be of little use for analysis purposes.

With this article I don't want to demonize the model created by PlanB, but rather want to highlight its pros and cons.

So far the S2F has proved to be the most accurate model in identifying the trend of the price of Bitcoin, gaining the trust and approval of a large mass of investors.

Financial markets teach that history repeats itself periodically.

In this case, should history repeat itself, prepare to see Bitcoin at $1 million in the future.