4 reasons why Bitcoin could explode soon

Since February 24, when the war between Russia and Ukraine began, Bitcoin seems to have confirmed its hegemony in the crypto market, despite the uncertainties in the geopolitical and economic environment worldwide. Over the past two months, the price has consolidated above the important support level of $35,000, with a (failed) attempt to break the $50,000 mark. Although the short-term price action reveals uncertainty, the medium-long term price action opens the way to bullish scenarios, also appreciated by some institutional investors, who are continuing to increase their assets in satoshi.

New all-time highs for Bitcoin are on the way

There are 4 very good reasons why Bitcoin could make new all-time highs in the coming months. Let's have a look.

1. Do Kwon and Michael Saylor buy more Bitcoins

April 5 and 6, 2022 were days of buying for two of the crypto world's great whales. Indeed, both Terra Foundation and Microstrategy took the opportunity to increase their allocation in Bitcoin. Do Kwon, founder of Terra Foundation, announced in a tweet the purchase of $230 million in Bitcoin, equivalent to about 5040 BTC.  The large purchase of the Terra foundation is part of a broader plan that plans to carry out a medium to long-term savings plan using Bitcoin to collateralise the UST stablecoin. Do Kwon himself has said publicly that his goal is to become the second largest holder of Bitcoin in terms of tokens held, second only to Satoshi Nakamoto. Microstrategy also did not remain silent and on 5 April 2022 announced yet another strategic investment in Bitcoin, for the sum of approximately 190 million dollars (4167 BTC).

The large purchase of the Terra foundation is part of a broader plan that plans to carry out a medium to long-term savings plan using Bitcoin to collateralise the UST stablecoin. Do Kwon himself has said publicly that his goal is to become the second largest holder of Bitcoin in terms of tokens held, second only to Satoshi Nakamoto. Microstrategy also did not remain silent and on 5 April 2022 announced yet another strategic investment in Bitcoin, for the sum of approximately 190 million dollars (4167 BTC).  Such big purchases could soon set the conditions for a rally to new all-time highs.

Such big purchases could soon set the conditions for a rally to new all-time highs.

2. Spot ETFs May Be Coming Soon

On April 7, 2022, another futures ETF was approved by the Securities and Exchange Commission. This time managed by the “Teucrium” group, it joins those previously granted to ProShares, Valkyrie and VanEck.  After yet another approval, Michael Sonnenshein, CEO of Grayscale, a leading investment fund with Bitcoin and other cryptocurrencies on its balance sheet, tried to put pressure on the SEC to approve the first spot ETF. Sonnenshein tweeted that "if the SEC approves a Bitcoin futures ETF, it should also approve a Bitcoin spot ETF". The Grayscale Bitcoin Trust has already announced plans to convert its trust into an ETF, if the SEC will grant it. This could prove to be extremely positive as the assets managed by the most famous crypto fund in mainstream finance exceed $35 billion. One can easily guess what a bullish effect this approval could have on Bitcoin.

After yet another approval, Michael Sonnenshein, CEO of Grayscale, a leading investment fund with Bitcoin and other cryptocurrencies on its balance sheet, tried to put pressure on the SEC to approve the first spot ETF. Sonnenshein tweeted that "if the SEC approves a Bitcoin futures ETF, it should also approve a Bitcoin spot ETF". The Grayscale Bitcoin Trust has already announced plans to convert its trust into an ETF, if the SEC will grant it. This could prove to be extremely positive as the assets managed by the most famous crypto fund in mainstream finance exceed $35 billion. One can easily guess what a bullish effect this approval could have on Bitcoin.

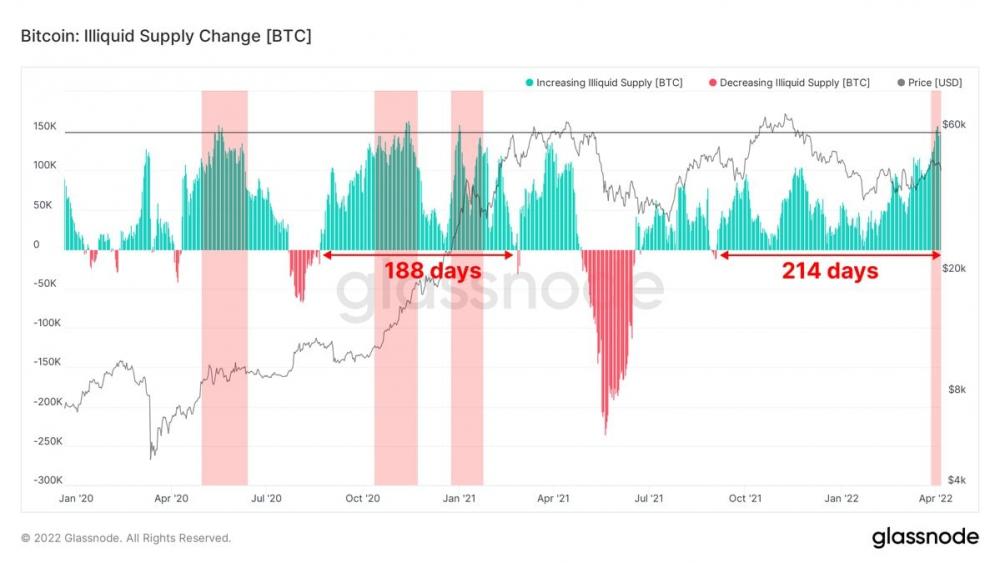

3. Bitcoin's Illiquid Supply Continues to Grow

Although the price of Bitcoin is struggling to return to pre-dump levels of May 2021, the illiquid supply of Bitcoin continues to increase, confirming the long-term uptrend. The amount of illiquid Bitcoin, i.e. not on exchanges but on non-custodial wallets, has reversed from a significant drop from May to July 2021 and is now in a 214-day accumulation period (still ongoing). This is even higher than the accumulation period in 2020, which lasted 188 days.

4. Strike implements the Lightning Network on Shopify

From now on, the Strike payment network can be used by more than 2 million merchants to receive payments in Bitcoin on Shopify. This was announced by Jack Mallers, CEO of Strike, during the Bitcoin Miami 2022 conference. Shopify merchants will be able to take advantage of the layer 2 "lightning network" to collect Bitcoin payments through a more cost-effective and scalable solution than the main Bitcoin network and even the current payment system. In fact, payment through the lightning network provides for very low fees and almost instant speed, allowing those who use it to shorten the settlement times, currently estimated between 2 and 15 days for the current electronic payment method in Fiat currency.  Who knows, maybe Strike's integration on Shopify will inspire other e-commerce giants and bring Bitcoin to the table of many more entrepreneurs. The road to mass adoption is still long, but it has never been closer!

Who knows, maybe Strike's integration on Shopify will inspire other e-commerce giants and bring Bitcoin to the table of many more entrepreneurs. The road to mass adoption is still long, but it has never been closer!