Move To Earn StepN: a (constructive) review of "Scalping the Bull”

In these days there is a lot of discussion about StepN Project, which, said in a very short summary, is a new Web3 App based on Blockchain Solana through which, by buying NFT sneakers, you can earn crypto while walking, in the style of Move-To-Earn projects. DISCLAIMER: with this article the Token Party team absolutely does NOT intend to offend, accuse or put in a bad light anyone. Our intention is rather to propose a constructive content (hopefully interesting!) to stimulate the Community of Crypto Enthusiasts to discuss and compare themselves on one of the most popular projects of the time and that is StepN.Moreover, this article is NOT to be considered in any way as a financial advice. Token Party does NOT have any active collaboration with the project StepN, so the contents that will follow are purely informative.

StepN: Why we do not agree with Scalping the Bull

Starting from the necessary premise that, as Crypto Enthusiasts, we appreciate the work of divulgation that "Bull" carries out and we recognize his undoubted skills in the technical analysis and scalping trading, but we want to express our disagreement on his evaluations about the StepN project. And we do it because we strongly believe that it is fundamental to promote in the best way possible the knowledge of the basic concepts of Web3 if you intend to operate on the Blockchain and create a decentralized economy, far from the mechanisms of traditional financing. Specifically we refer to the video shot by Scalping the Bull about StepN entitled "STEPN A NEW SCHEME PONZI OF DEFI ? | SHORT GMT ? | YOU SUCK". (You can watch the full video of by clicking here). Bull's interpretations only focus on the simplicity of the reward mechanism that gives money to users. Such a simplicity of reward that Scalping the Bull claims that StepN is a Ponzi Scheme. But the things are not exactly this way. Let's see why by analyzing two of his statements.

- Affirmation N.1 - (min : 1.43)

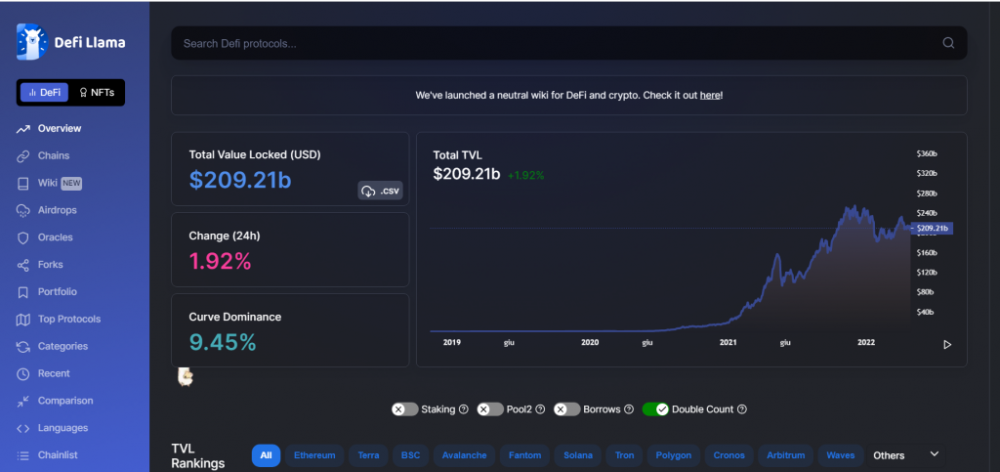

"DeFi giving away money like this, money raining from the sky."CRITICAL: It is wrong to directly associate DeFi with a Move-To-Earn application. Move-To-Earn platforms represent 1% of the entire DeFi application ecosystem. Generalizing in this way is not okay. Classifying DeFi as a money-giving medium is naïve and does not take into account automated market makers, liquidity pools, smart contracts, money lending, farming pools, and the current $209 BILLION locked up in DeFi proxies, according to DefiLama data.  Money doesn't rain from the sky! The Move-To-Earn or Play-To-Earn platforms like Axie Infinity, Thetan Arena, and Stepn have an incentive mechanism that rewards users for simple actions in a more or less consistent way. The sustainability (the "sustainability" of a project is the key to distinguish a Ponzi Scheme from a legitimate platform) and the possibility to make a "payment" for these simple actions is explained through the data of the tokenomics, or better, of the dual tokenomics of Stepn.

Money doesn't rain from the sky! The Move-To-Earn or Play-To-Earn platforms like Axie Infinity, Thetan Arena, and Stepn have an incentive mechanism that rewards users for simple actions in a more or less consistent way. The sustainability (the "sustainability" of a project is the key to distinguish a Ponzi Scheme from a legitimate platform) and the possibility to make a "payment" for these simple actions is explained through the data of the tokenomics, or better, of the dual tokenomics of Stepn.

The Dual Tokenomics of Stepn: GMT and GST

Stepn is based on two different tokens:

- Step (GMT), governance token. Max supply set at 6 billion tokens

- Green satoshi token (GST), utility token, which is used as a reward for users who walk or jog. Max infinite supply. It is true, very often the tokens that are "given away" for performing actions such as, for example, playing a video game or walking, suffer from the high supply (sometimes infinite, as in the case of GST) and tend to depreciate over time.

However, this does not mean that StepN is a Ponzi Scheme! Said that the elevated supply is sure a given of the tokenomics to hold ABSOLUTELY in account if s'intesse to estimate an investment, contextualizing it also to the prices of market, to the prices of the sneakers NFT (they are not fixed, but variable) and to other variable.

- Affirmation N. 2 - (min 1.53)

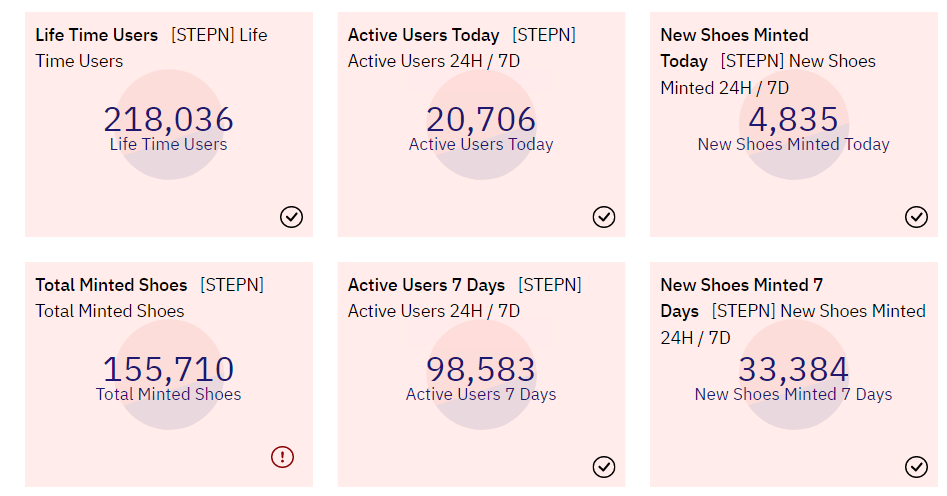

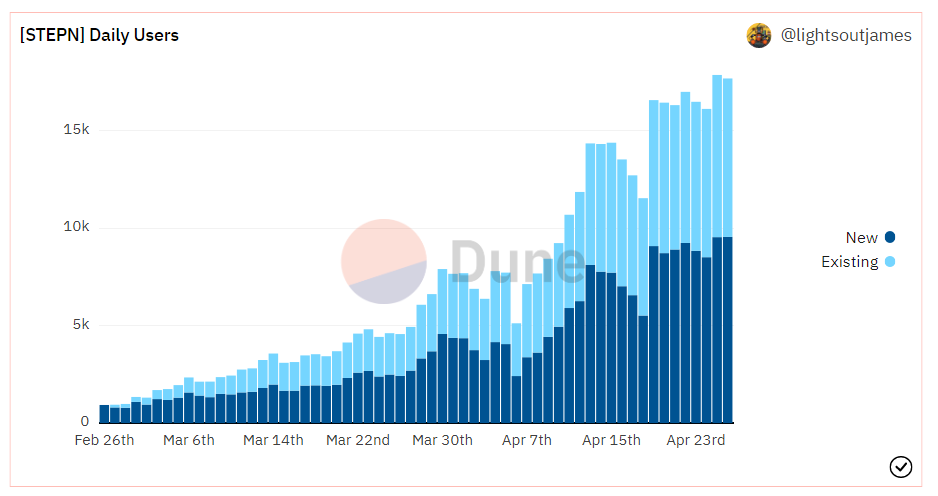

"You walk you get money, whose money is it? It's yours! What does this remind you of? A Ponzi Scheme."CRITICAL: No, the "money," aka GST, that given as a reward for walking or jogging, is not yours. The mechanism, simplifying, is as follows: You pay, in SOL (Solana), a sneakers NFT, whose price varies mainly according to the performance of GST, token used as a reward up to level 30 (from there on you can choose whether to earn in GMT). Obviously the prices are aligned according to the market trend of GST and GMT. In addition, the sneakers can be resold in the marketplace, so in case an investor is in unfavorable conditions because, for example, he bought the NFT and after two months the GST token is dumped, he could still resell the NFT in the marketplace or continue to play sports to accumulate or sell a coin to market. You don't get completely screwed! There is no one running away with the loot, there is no scam or deception. There is no company that closes its doors. Simply as in any market, there is someone who gains and there is someone who loses. It's all about choosing the most opportune time frame to make the most profit. Calling a Move-To-Earn application a "DeFi Ponzi Scheme" is unfair and insulting to those who dedicate hours and hours of work every day to develop and enhance the industry. A Web3 application that in just 57 days manages to sign up more than 200,000 users should be awarded rather than burnt at the stake. To support our point, we attach some metrics proposed by Dune.

Final Considerations While we understand Bull's motivations for questioning the sustainability of Stepn, we thought it would be appropriate to point out these elements taken for granted or overlooked during his analysis. In our opinion, the incentive system proposed by Stepn is sustainable because NO MONEY FROM NEW MEMBERS IS USED TO REPAY THE FIRST. What will most likely become "unsustainable" is the bullish trend of the two tokens GMT and GST. We believe that, in the coming weeks/months, the price of these two tokens will dramatically deflate, causing losses (or lengthening the break even time on the investment) to those who purchase NFT sneaker today. Most likely GST will experience greater selling pressure over time than GMT. In the future prices could stabilize towards a fair price and the investment on sneakers could perhaps be more profitable than it is today. We will see. It's all a question of timing. Anyway, as always we remain open and available to dialogue and comparison.

Final Considerations While we understand Bull's motivations for questioning the sustainability of Stepn, we thought it would be appropriate to point out these elements taken for granted or overlooked during his analysis. In our opinion, the incentive system proposed by Stepn is sustainable because NO MONEY FROM NEW MEMBERS IS USED TO REPAY THE FIRST. What will most likely become "unsustainable" is the bullish trend of the two tokens GMT and GST. We believe that, in the coming weeks/months, the price of these two tokens will dramatically deflate, causing losses (or lengthening the break even time on the investment) to those who purchase NFT sneaker today. Most likely GST will experience greater selling pressure over time than GMT. In the future prices could stabilize towards a fair price and the investment on sneakers could perhaps be more profitable than it is today. We will see. It's all a question of timing. Anyway, as always we remain open and available to dialogue and comparison.